All Categories

Featured

Table of Contents

Prostock-Studio/ GOBankingRates' editorial group is dedicated to bringing you impartial reviews and info. We utilize data-driven approaches to assess monetary items and services - our reviews and ratings are not influenced by advertisers. You can learn more concerning our content guidelines and our services and products assess technique. Infinite banking has actually recorded the interest of several in the individual financing world, assuring a course to monetary flexibility and control.

Unlimited banking describes an economic method where a private becomes their own lender. This principle revolves around using whole life insurance policy plans that build up money worth over time. The insurance policy holder can obtain versus this money worth for numerous financial needs, efficiently loaning money to themselves and settling the policy on their very own terms.

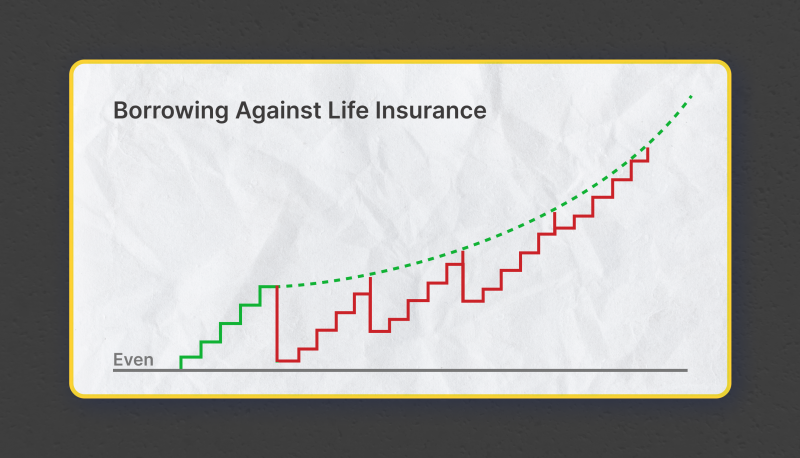

This overfunding increases the development of the policy's cash money worth. The insurance holder can then obtain against this cash worth for any objective, from financing an automobile to purchasing realty, and afterwards pay off the lending according to their own routine. Infinite banking uses numerous advantages. Below's a check out a few of them. Infinite Banking vs traditional banking.

Infinite Banking Benefits

It involves utilizing an entire life insurance plan to create a personal funding system. Its effectiveness depends on various aspects, consisting of the plan's structure, the insurance policy company's performance and exactly how well the strategy is managed.

It can take numerous years, frequently 5-10 years or more, for the cash value of the policy to expand adequately to begin borrowing versus it effectively. This timeline can differ depending on the policy's terms, the costs paid and the insurance firm's efficiency.

How do I leverage Infinite Banking Wealth Strategy to grow my wealth?

As long as costs are existing, the policyholder merely calls the insurer and requests a finance versus their equity. The insurance company on the phone won't ask what the car loan will certainly be utilized for, what the earnings of the customer (i.e. insurance policy holder) is, what other assets the individual might need to act as collateral, or in what timeframe the person means to repay the funding.

Unlike describe life insurance policy items, which cover only the beneficiaries of the insurance holder in the event of their death, whole life insurance covers a person's whole life. When structured appropriately, entire life plans create an unique income stream that raises the equity in the policy in time. For additional analysis on exactly how this works (and on the pros and disadvantages of entire life vs.

In today's world, one driven by ease of consumption, way too many take for provided our nation's purest beginning concepts: flexibility and justice. Most individuals never ever stop to think about just how the products of their bank fit in with these merits. We position the easy inquiry, "Do you feel liberated or warranted by operating within the restrictions of business lines of credit?" Click below if you want to find an Accredited IBC Professional in your location.

What are the tax advantages of Infinite Banking Wealth Strategy?

Lower finance passion over plan than the standard lending items obtain collateral from the wholesale insurance plan's money or abandonment worth. It is a principle that enables the policyholder to take lendings on the entire life insurance coverage plan. It needs to be readily available when there is a minute monetary worry on the individual, wherein such fundings might help them cover the financial tons.

The insurance holder needs to link with the insurance business to ask for a funding on the policy. A Whole Life insurance coverage plan can be called the insurance policy product that supplies defense or covers the person's life.

It begins when a private takes up a Whole Life insurance plan. Such policies retain their worths due to the fact that of their traditional technique, and such policies never ever spend in market instruments. Boundless banking is a concept that permits the policyholder to take up loans on the whole life insurance policy.

How do I optimize my cash flow with Bank On Yourself?

The money or the surrender value of the entire life insurance policy functions as collateral whenever taken car loans. Mean an individual enrolls for a Whole Life insurance policy plan with a premium-paying term of 7 years and a plan duration of two decades. The specific took the plan when he was 34 years old.

The collateral acquires from the wholesale insurance coverage plan's money or abandonment value. These factors on either extreme of the spectrum of realities are talked about below: Infinite financial as a financial advancement boosts cash money circulation or the liquidity profile of the insurance policy holder.

Generational Wealth With Infinite Banking

In monetary dilemmas and difficulties, one can utilize such products to get financings, thereby mitigating the problem. It uses the most affordable money expense compared to the standard lending product. The insurance coverage financing can likewise be readily available when the individual is unemployed or encountering health issues. The entire Life insurance coverage policy maintains its total value, and its efficiency does not relate to market efficiency.

In addition, one must take just such policies when one is financially well off and can handle the plans costs. Limitless financial is not a scam, however it is the ideal thing a lot of individuals can decide for to enhance their monetary lives.

What type of insurance policies work best with Infinite Banking Concept?

When individuals have limitless financial described to them for the first time it feels like a wonderful and safe way to expand wide range - Financial independence through Infinite Banking. The concept of replacing the despised bank with loaning from yourself makes so much more feeling. Yet it does need changing the "despised" financial institution for the "despised" insurance coverage firm.

Certainly insurance provider and their agents enjoy the idea. They created the sales pitch to market more entire life insurance policy. However does the sales pitch meet real life experience? In this article we will certainly first "do the math" on boundless banking, the financial institution with on your own approach. Because fans of boundless banking may assert I'm being biased, I will make use of display shots from an advocate's video and connect the whole video clip at the end of this write-up.

There are two major monetary catastrophes built right into the infinite banking concept. I will certainly reveal these flaws as we function via the mathematics of just how infinite financial actually works and how you can do a lot better.

Latest Posts

Infinite Banking Concepts

What Is A Cash Flow Banking System

R Nelson Nash Infinite Banking Concept